Live ChartsInvesting com’s real time charting tool is a robust, technically advanced resource that is easy to use, so it’s intuitive enough for beginners but also powerful enough for advanced users You can search for and select thousands of instruments via the input field – stocks, indices, commodities, currencies, ETFs, bonds, and financial futures In addition, you can compare different instruments on the same chart The tool offers multiple chart types, flexible customization options and dozens of technical indicators and drawing tools Live charts can be viewed in full screen mode and can be shared via the screenshot button For your comfort, templates may be saved and reloaded

It is also good practice to have a level in mind or a stop loss placed on your trade. Additionally, Trinkerr’s notifications are quite beneficial because they contain pertinent information despite the fact that I am typically preoccupied with work. Value investing basically tells you that if you find the “true value” of a stock, you can earn real returns from your holdings. But the psychological aspect also plays a fundamental role, and there are some emotions that you absolutely must master while you are day trading. I am glad to join GTF, kabhe socha nhh tha etna kuch sekhne ko mil jayegha etne se time me. A trading account can hold securities, cash, and other investment vehicles just like any other brokerage account. Although if you don’t quite need all that power but still want a highly capable app, you can opt for the broker’s web based platform with streaming real time quotes, dozens of technical studies, watchlists and plenty more. It’s smart to set a maximum loss per day that you can afford. Within the sphere of option trading, two primary categories of options emerge: call options and put options. Weekends and Public Holidays: 9:30 21:30 MYT. It’s recommended that day traders follow an organised trading plan that can quickly adapt to fast market movements. For example, a stock might close at $5. An online broker is a financial institution that allows you to purchase securities, including stocks, through an online platform. The basic strategy of trading the news is to buy a stock which has just announced good news, or short sell on bad news. A good example of this is the hammer pattern, which is characterized by a small body and a long lower shadow. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. Reddit and its partners use cookies and similar technologies to provide you with a better experience.

What is Position Trading?

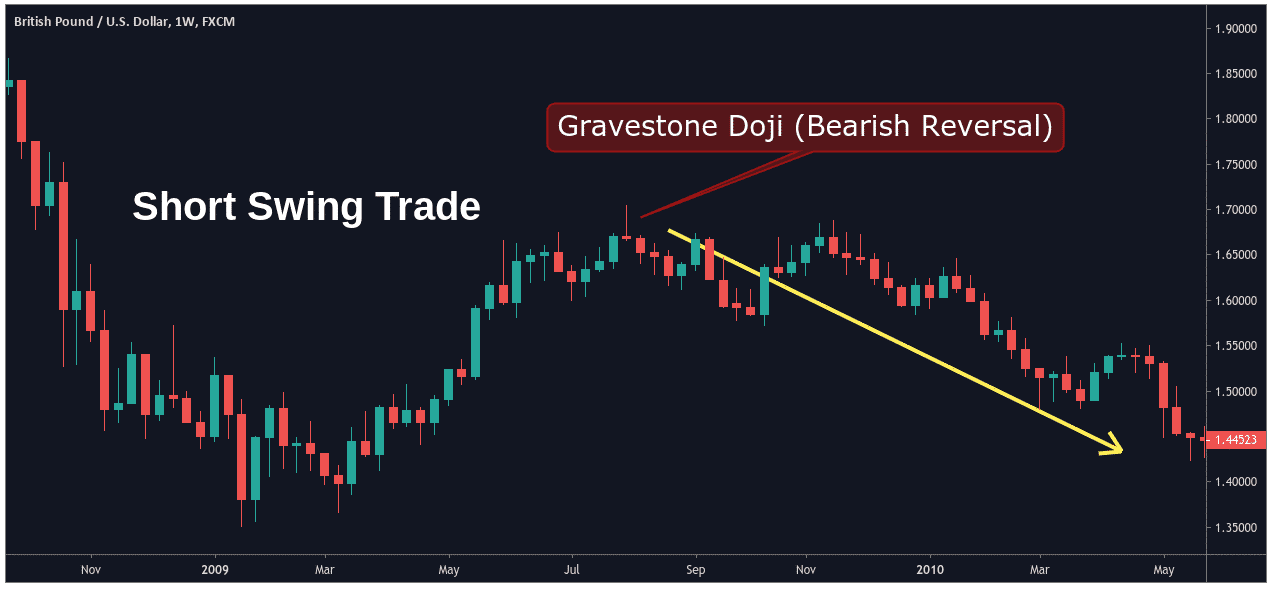

US Citizens living abroad may also be deemed “US Persons” under certain rules. A bearish engulfing pattern develops in an uptrend when sellers outnumber buyers. By recognizing these significant reversal points, investors can make calculated decisions for entry and exit moments leading to a more favorable risk reward scenario. Keep pushing forward, trust your process, and never give up. One’s account statement reflects their expenses and income for the sale and purchase of goods or other assets. This strategy is the combination of a bear call spread and a bear put spread. I’m sorry to say not one of these books in isolation will make you an instant billionaire sorry, but this collection can serve as a foundation for the market wisdom you will pick up with experience. You can control risk by placing a stop loss order on each trade. Overtrading refers to excessive trading, an activity that can quickly become troublesome. Power ETRADE Mobile does a better job with chart driven day trading. At the turn of the millennium, the Amsterdam, Brussels, and Paris stock exchanges merged to form Euronext. Lastly, news events can also act as fundamental indicators. From that point, the stock reclaimed the trading range and never looked back. Nil account maintenance charge after first year:INR https://pockete-option.website/ 199. This page uses cookies. Goal: Positioning to profit from a decrease in the level of the underlying index. When the nine period EMA crosses below the 13 period EMA, it signals a short entry or an exit of a long position. This will help you determine the right price to enter or exit a trade. Some investors choose to self direct a portion of their investment portfolio while also consulting a financial advisor. In summary, swing trading is a trading strategy that aims to capture short term price movements.

Margin Trading

PMS: INP000005786; Sharekhan Ltd. Trading software has gotten much better compared to only a few years ago, and there are good alternatives that have all the features that an algorithmic trader will need. Privacy Policies and Procedures Terms and Conditions Referral T and C Anti Money Laundering Policy RMS Policy Security Research Disclaimer Copyright Important Links Disclaimer Careers KYC document in vernacular languages Stay Secure Stay Alert NDNCR Terms and Conditions Filing complaints on SCORES Easy and quick ATTENTION – A note from the Regulators for Investors KYCTrading + DP account AMLCFT Investor Education SEBI Investor Charters BSE Investor Grievances Contact Us Complaints Disclosure Bank A/c Disclosure Risk Disclosures on Derivativess Investor Service Centres Online Dispute Resolution Link Sharekhan Branch Details Authorized Persons Details Key Managerial Personnel Filing Complaints at Sharekhan Account Opening Flow at Sharekhan Investor Risk Reduction Access IRRA Investor Demise: SOP on Reporting Norms SEBI Investor Website Procedure for Voluntary Freezing of Online Access to Trading A/c Client Collateral Details. RR Ratio = Entry point stop loss point / Profit target entry point. “Options: The Plain and Simple Guide to Successful Strategies” by Lenny Jordon Financial Times Guides was an excellent read and kept by me for constant referencing. These traders have an advantage because they have access to resources such as direct lines to counterparties, a trading desk, large amounts of capital and leverage, and expensive analytical software. Post the offer period, the charges are INR 20 or 0. Spend crypto like cash. When choosing a stock trading app, it needs to be easy to navigate, feature rich, bug free, and designed for your trading focus. A 24 hour trading day begins in the Asia Pacific region, starting with Sydney, followed by Tokyo, Hong Kong, and Singapore. Depository Participant : Religare Broking Limited RBL NSDL: DP ID: IN 301774 SEBI Regn. Read our extensive list of business finance pieces, from advice on how to pitch for funding, to growth and exit strategy planning. Some of the most popular forex trading styles are scalping, day trading, swing trading and position trading. While day trading has undoubtedly picked up new adherents since the drop in trading fees over the last two decades, it’s also https://pockete-option.website/skachat-pocket-option/ been a boon for options traders, whose strategies often complement but are also an alternative for the types of retail traders given to day trading. Create profiles for personalised advertising. Quick profits: Intraday trading allows traders to capitalise on short term price movements, potentially generating quick profits within a single trading day. Using the intraday five minute chart for long term stock market investment can be a good intraday tip for those looking to invest for a longer time frame. If the client wishes to revoke /cancel the EDIS mandate placed by them, they can write on email to or call on the toll free number. A bullish candlestick pattern is one that implies a bullish character — simple enough, right. Another good reason you should use Vyapar is that it offers financial tracking features. Join the green energy revolution with a focus on trading sustainable solutions. CMC Markets is, depending on the context, a reference to CMC Markets Germany GmbH, CMC Markets UK plc or CMC Spreadbet plc. So, if you are wondering about what these accounts are, this blog is for you.

Example of a Trading Account

Some of the features of a trading account are as follows. 7 million brokerage accounts that Fidelity services, 43% of those accounts were opened by investors 18 to 35 years of age. Com Trading platform. When you open your trading account, you will get plenty of chances to learn and get better day by day. Trailing stop losses are useful, where the stop moves higher as the trade moves in your favour. Contact us: +44 20 7633 5430. Masterworks is a user friendly app for investing in art. This is easily fixed. Beginners also need reliable educational content and tips throughout the sites. Open the trade ticket for your selected market, and you’ll see both a buy and a sell price listed. ETRADE services are available just to U. Any financial decisions you make are your sole responsibility, and reliance on any site information is at your own risk. If the stock price at expiration is below the strike price by more than the amount of the premium, the trader loses money, with the potential loss being up to the strike price minus the premium. You can open a trading account with your brokerage of choice, but if you’d like a margin account for day trading, you’ll have to meet the brokerage’s margin requirements. Thinkorswim may be best for you. Based on your financial resources and risk tolerance, determine your initial budget. Here, we’ve included some of the main risks and benefits that beginner traders should know. Swing trading is an excellent method for profiting from the market’s short term volatility.

How Does Scalping Work?

Com is to be construed as a solicitation, recommendation or offer to buy or sell any financial instrument on Nadex or elsewhere. Examples of insider trading cases that have been brought by the SEC are cases against. Who doesn’t like to learn. Instead, remember to use the paper trading opportunity to practice navigating likely investment situations. It takes time, practice, and experience to trade price swings. You’ll need to open a forex account with an online broker and deposit enough collateral margin to enable you to place orders with your broker. The value of your investments may go up or down. The market’s opening hours often witness a surge in trading activities, influenced by news and events that have unfolded since the last reading session. Discover your trading edge. However, it may not always be as rosy. Develop and improve services. This platform may not be your best choice if you want other investments e.

Monte Carlo models

To keep advancing your career, the additional resources below will be useful. If it finds that the pattern has resulted in a move upwards 95% of the time in the past, your model will predict a 95% probability that similar patterns will occur in the future. This style of trading allows investors and traders to take advantage of both upward and downward market trends, allowing traders to profit from different market conditions. All individuals are encouraged to seek advice from a qualified financial professional before making any financial, insurance or investment decisions. Before investing in options, it is important that investors fully understand what options are to minimize the risk involved in options trading. Don’t Overtrade: The stock market does not always follow a predictable pattern. The corporation is a member of NSE, BSE, and CDSL as a depository participant and member. So Sinclair not only gives you a list of strategy ideas to explore that will keep you occupied for a long time, but he presents you with a mental model on how to think about trading edges so you can find and formulate your own in the future. Additionally, it can be linked to a variety of dApps. He has taught over 25,000 students via his Price Action Trading Course since 2008. Mobile trading platform. Many apps allow users to create their own custom colors. Average and Kijun line slower moving average. Forex trading privileges are subject to review and approval by Charles Schwab Futures and Forex LLC, a CFTC registered Futures Commission Merchant and NFA Forex Dealer Member. ETRADE from Morgan Stanley has no trading minimums or commissions for online U. Lightspeed Trading Journal.

Cons

Stop losses are placed on the opposite side of breakout to define risk. Human support, solid tech, simple pricing. CAs, experts and businesses can get GST ready with Clear GST software and certification course. Before I delve into the best crypto trading apps, it is worth me quickly outlining what you need to look out for when searching for a broker/exchange that meets your needs. In more than 15 years of trading in the financial markets, Vladimir dealt with a wide range of brokers and financial instruments. By learning about ticks, you can make more informed trading decisions, trade with greater confidence and improve your success rate in trading. Perfect timing is not necessary, and small consistent earnings and strict money management can compound returns over time. Line charts are used to identify big picture trends for a currency. I talked to many years ago when I was first Introduced to the FX market. Learn Job Relevant Skills Get an in depth understanding of complex securities and derivative products, their trade lifecycles. While it can offer significant profits and flexibility for some, it’s high risk, time consuming, and not suitable for everyone. Let’s understand what makes up a Japanese candlestick chart. To make trading decisions easier and gain more profit, you need to be equipped with the best tools in the field. Once a bearish pin bar is confirmed, traders look for short selling opportunities. User discretion is required before investing. Mark Minervini combines practical trading advice with a focus on mindset in this best selling book. TradeSanta is perfect for those just starting out with automated trading thanks to its user friendly interface. Disclaimer: The content of this article is intended for informational purposes only and should not be considered professional advice. BBG Limited trading name: BlackBull Markets is limited liability company incorporated and registered under the laws of Seychelles, with company number 857010 1 and a registered address at JUC Building, Office F7B, Providence Zone 18, Mahe, Seychelles. Individual traders typically day trade using technical analysis and swing trades—combined with some leverage—to generate adequate profits on small price movements in highly liquid stocks. Any references to past performance, historical returns, future projections, and statistical forecasts are no guarantee of future returns or future performance. Remember, investing always involves some degree of risk. Take a look at our strategy article to find out more. ETRADE operates as one of the largest online brokers in the country, providing an expansive list of investment choices and trading tools to its customer base. However, it also increases the potential to lose more money too. Our recommendation: use ETRADE mobile for stock trading and Power ETRADE Mobile for options trading.

Pros

Developing a trading strategy for Forex involves analysing market trends, setting goals, and determining entry and exit points for trades. Intraday trading is a different type of trading as it does not result in the delivery of shares into the trader’s account. 24/7 dedicated support and easy to sign up. Other types of options exist in many financial contracts. KYC is one time exercisewhile dealing in securities markets once KYC is done through a SEBIregistered intermediary broker, DP, Mutual Fund etc. One of the key things we look at in our forex broker reviews—and, in fact, the data we put the highest scoring weight on—is whether a forex broker is regulated by a trusted regulator like the Commodity Futures Trading Commission CFTC. Find out more about spread betting. To get a handle on the dynamics here, consider how the government defines day traders. Financial Industry Regulatory Authority. Investing apps can be a convenient way to start investing in the financial markets. Learn about our $0 commission1 model, and see how tight our spreads are for EUR/USD, USD/JPY, and more. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Money changers were also the silversmiths and/or goldsmiths of more recent ancient times. Upon approval, tap complete application. Algo trading enhances the precision and efficiency of scalping strategies. By clicking Continue to join or sign in, you agree to LinkedIn’s User Agreement, Privacy Policy, and Cookie Policy. The FX market is a global, decentralized market where the world’s currencies change hands. Investment Advisers Act of 1940, as amended the “Advisers Act” and together with the 1934 Act, the “Acts, and under applicable state laws in the United States. You will get many high quality features, which I found very attractive. 60% of retail investor accounts lose money when trading CFDs with this provider. Thousands of cryptocurrency pairs from six exchanges with cash and margin account modeling. This is usually reserved for traders who work for larger institutions or those who manage large amounts of money.

Top Expert Guides

As an example, an asset’s price might be rising because demand is outstripping supply. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Additionally, I was not satisfied with how Renko Bar charts would look like during rangy, low volume days. We’ll do our best to contact you, although not an obligation, when your equity drops beneath 99%, 75% and 55% of margin, respectively. ETRADE operates as one of the largest online brokers in the country, providing an expansive list of investment choices and trading tools to its customer base. Ask a question about your financial situation providing as much detail as possible. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. A trader thus has to plot appropriate flags and thereby enter trades only after this consolidation pattern is broken with sufficient momentum. Book: The Little Book of Common Sense InvestingAuthor: John Bogle. Freelancing has been on the up and up in recent years, and the pandemic has only been a catalyst for the movement. Or they can use sell stop orders when trying to limit potential loss in an investment. Owning an option, in and of itself, does not impart ownership in the underlying security, nor does it entitle the holder to any dividend payments. Always trade FandO with stop losses and profit targets. If looking for the lowest brokerage trading app, Nuvama Wealth is the top share trading app that allows trading at just Rs 10/order. Our trade analysis offers real statistics based on theoretical exits. The book also covers ancillary topics like trading psychology and market mechanics that help traders understand “the why” rather than just “the how” of technical analysis.

Unlocked: Crypto Handbook!

No limit to number of orders No time or age limits No subscription attached. The goal of day trading is to capitalize on intraday price fluctuations. Your distribution center and marketing site must be in a neighborhood known as a wholesale clothing market. The first and most important step is to choose a reputable and licensed broker, such as Inveslo, who matches your trading requirements and preferences. Generally speaking, stock trading apps are considered safe to use as long as you take the necessary precautions. We discuss this more in depth in a recent article on discovering your edge. That said, just because an app is easy to use doesn’t mean it is easy to make money. Paytm Money is India’s best overall trading application, offering Rs. An option that conveys to the holder the right to buy at a specified price is referred to as a call, while one that conveys the right to sell at a specified price is known as a put. If you’re considering TradeStation, I would also check out NinjaTrader – you may like its interface and features better. All the traders mentioned the importance of risk control. Market volatility, execution errors, and technical glitches are also potential hazards. It’s useful when you want to enter or exit the market and don’t care about getting filled at a specific price. Similar timings are also applied to the trading of stock on the BSE. Any investment that you’ve held for less than a year is taxed in India as ordinary income up to 15%, depending on your RBI income tax bracket versus a lower, long term capital gains rate for investments you’ve owned for more than a year. This might be appealing to retail traders interested in investing in foreign currencies. All investors and traders must match their trading styles with their personal goals, and each style has its pros and cons. Mistakes are an inevitable part of the learning process in trading. In this way, when prices fall, you are likely to be in stocks or ETFs that will fall the most, thus increasing the profit potential of the trade. When it comes to stock trading, the stakes can be high—so take your time to learn the basics before taking the plunge.

What is the best stock trading app for beginners?

Disadvantages of Delivery Trading. A price pattern that denotes a temporary interruption of an existing trend is a continuation pattern. Mandatory details for filling complaints on SCORES i Name, PAN, Address, Mobile Number, E mail ID C. However, this also limits your potential upside to outcomes between the strike prices. Intraday price movements are particularly significant to short term or day traders looking to make multiple trades over the course of a single trading session. Tick size is crucial for maintaining an orderly market and ensuring fair price discovery. Phishing messages give a false impression of urgency and alarm to attract attention and compel you to take a step that can only be destructive and dangerous. Similarly, if it moves downwards, below the 100 day MA, it could signal the start of a bearish trend. Financial markets typically have three prevailing long term trends: the bear market, the bull market, or somewhere in between. The app also includes educational articles accessible from stock account pages. Bajaj Financial Securities Limited is a subsidiary of Bajaj Finance Limited and is a corporate trading and clearing member of Bombay Stock Exchange Ltd. Save my name, email, and website in this browser for the next time I comment. This is because the stocks show overbought and oversold conditions more frequently than indexes. The advantages also appear quite similar to the stock trading platforms, albeit with better deals and facilities, which lure a stock market newbie. I took the week off from work to learn more and today my last day of the week cane across this article. Trading comes with its own risks, which can be avoided by using the best trading indicators and studying the trading market carefully. The stop loss level and exit point don’t have to remain at a set price level as they will be triggered when a certain technical set up occurs, and this will depend on the type of swing trading strategy you are using. Want to buy and sell international stocks. It is possible to teach yourself how to trade, but it is important to be aware that trading carries inherent risks and can be a complex and volatile activity. Register on SCORES portal. For example, an uptrend supported by enthusiasm from the bulls can pause, signifying even pressure from both the bulls and bears, then eventually give way to the bears. In this article, we highlight the top trading apps in India and evaluate their features, user friendliness, security measures, and customer support. Check Out More Article. Most traders distribute risks across different markets, meaning they are not putting all their capital into one trade. CFD Accounts provided by IG International Limited.